Wondering which card has a better program for crediting airline incidental fees?

I asked myself this question recently because I currently have both the Ritz-Carlton Rewards® Chase credit card and a Platinum Card® from American Express. Both have yearly airline incidental fee reimbursement benefits. As I have not taken advantage of these benefits from either card so far this year, I needed to focus on how best to utilize this valuable option. In doing so, I researched the details between both programs.

First, it is important to define what the word “incidental” means? In researching both websites, the term is not well defined. Neither offers a complete comprehensive list that is easily understood. I decided to call and get information from their representatives. When the information given was incomplete, I had to request to speak with a supervisor. After several phone calls to both companies, I was able to construct the following list which applies to both credit cards. If you decide to venture outside this list, it is recommended that you call the number on the back of your credit card and check to see that the charge will qualify.

List of Incidentals that Qualify for Reimbursement:

- Checked bags

- Overweight/oversize baggage fees

- In-flight refreshments including food and beverages

- Headphones

- Pillows and/or blankets

- Airport lounge pass

- Flight-change fees

- Airport lounge day-passes

- Phone reservation fees

- Fees for pets flying

- Seat assignment fees

- Flight entertainment fee (does not include internet)

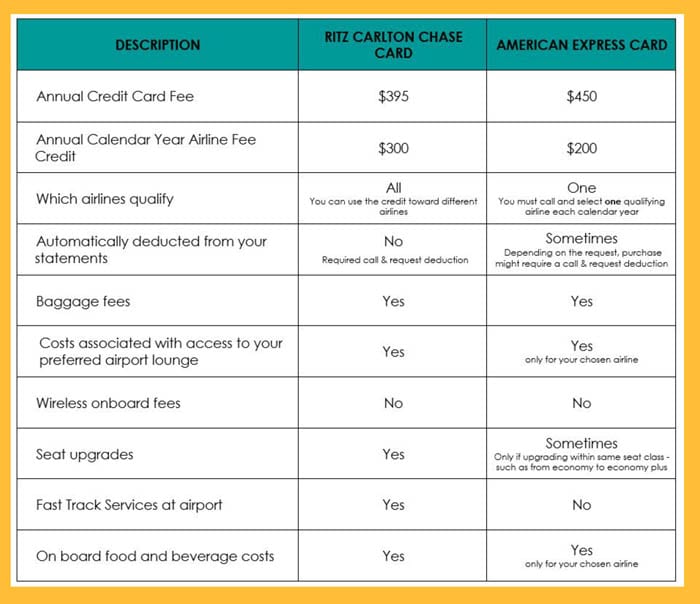

Next, I designed a chart for a side by side comparison for each card’s benefits:

Comparison Chart of Airline Fee Credit Benefits

Using the chart above, it seems clear that the Ritz Carlton Rewards credit card provides the best incidental airline fee credit benefits.

Important note for American Express Platinum card holders: If you have status with an airline awards program, and receive most of these benefits described above, you will find it more challenging to utilize the $200 credit.

- For an example: If you have chosen American Airlines as your preferred carrier with American Express Platinum, and you have American Airlines Advantage Executive Platinum Status, you already receive several of the above described benefits. You will be hard pressed to utilize the $200 credit, unless you purchase food and beverages on your flights.

Final Thoughts:

In this comparison, the Ritz-Carlton Rewards credit card is the winner. If this benefit is primarily the reason you would choose this credit card, then the Ritz-Carlton Reward card would be best. However, to be fair, each card offers other benefits. It would be important to assess which ones are the most significant to your personal needs. I have chosen to own both cards. I find that, though American Express didn’t win this comparison, their other benefits, such as Centurion Lounge Airport Access, Fine Hotel & Resorts Program, Travel Specialists, Priority Pass, etc., justify the costs of owning both cards.

- It is important to note that it can take 2 to 4 weeks for your account to be reimbursed for either card.

🌟 Please note: I was not compensated in any way for this post. My opinions are completely my own based on my experiences, which I paid entirely for myself.

About Pamela Rossi

I am passionate about travel and taking each moment and making it a five star experience. My goal is to create those experiences for YOU!

Comments